Press Release Back to NEWS Page

| August 11, 2017

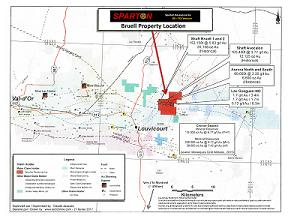

Sparton Resources Inc.: Company to Explore Strategic Quebec Gold Property TORONTO, ONTARIO–(Marketwired – Aug. 11, 2017) – Sparton Resources Inc. (TSX VENTURE:SRI) (“Sparton” or the “Company“) announced today that it has entered into an option agreement with two independent prospectors (the “Vendors”) to explore the 20 claim Bruell Property (“the Property”) in Vauquelin Township, Quebec. The Bruell claims are located approximately 35 kilometers east of the prolific Val d’Or gold exploration and production area. Under the terms of the 5-year option agreement Sparton will issue a total of 1,500,000 Common Shares, incur a total of $1,500,000 in exploration expenditures on the claims, and make cash payments totaling $300,000 over the 5-year period to earn a 100% interest in the Property as follows: Signing: On Receipt of Regulatory Approval: cash payment of $25,000, 100,000 shares issued, and exploration expenditures of $100,000 in first year. (Firm commitment) End of Year 1: Cash payment of $20,000, 150,000 shares issued, and exploration expenditures of $100,000. (Optional) End of Year 2: Cash payment of $30,000, 200,000 shares issued, and exploration expenditures of $300,000. (Optional) End of Year 3: Cash payment of $50,000, 350,000 shares issued and exploration expenditures of $400,000. (Optional) End of Year 4: Cash payment of $75,000, 500,000 shares issued and exploration expenditures of $600,000. (Optional) End of Year 5: Cash payment of $100,000, 200,000 shares issued and exploration expenditures of $600,000. (Optional) Production Royalty: If commercial production takes place on the Bruell property, the Vendors collectively, will be entitled to receive an annual production royalty (the “Royalty”) equal to 2% of Net Smelter Returns as customarily defined. At any time after a feasibility study is completed for development of any part of the Property 1/2 of this Royalty (or 1%) may be purchased by the Company for the sum of $1,000,000. All cash payments share issuances, and royalty payments if any, will be paid or issued as to 50% of the totals to each prospector. The agreement has received regulatory and Company board approval. About the Bruell Property There are numerous surface showings of steeply dipping vein and shear zone hosted mineralization and at least 4 priority areas with past diamond drill hole intersections that require follow up evaluation. The last drilling program on the property was in 2005. Only surface work has been completed by the prospectors since that time. The claims are underlain by dominantly mafic volcanic rocks with a central granodiorite porphyry intrusion (the Bruell Pluton) that has not been explored. Several of the better grade gold zones are associated with magnetic diorite intrusions (Aurora) and quartz feldspar porphyry dykes and sills related to the Bruell Pluton (Bruell 1,2). A comprehensive ground magnetic survey has not been completed on the claim group. Limited magnetic surveys covering the principal gold zones near the shafts have indicated well defined magnetic anomalies related to the rock types hosting the mineralized structures. Historical estimates for gold mineralization are documented and summarized in various company and government reports. Combined historical estimates for Bruell 1,2 and Avocalon /Aurora as reported in the Northern Miner on Dec 22, 1960, and are summarized in Quebec Government Reports (32CO3-27) and by C2C Inc. (GM62277). These have summarized Reports by Bruell Gold Mines Ltd. from 1934-6 for the Bruell 1 and 2 vein systems as historical drill inferred estimates, and these are given as 165,000 tonnes at 4.78 grams per tonne Au (GM08615). These are also referred to in a 1963 report by A. C. Lee for Potter Gold Mines which included the Avocalon and Aurora structure drilling data along with Bruell 1 and 2 mineralization, which quoted a “historical mineral inventory” estimate of 220,0000 tonnes at 3.77 grams per tonne gold. Cautionary Statement It should be noted that these estimates do not include any more recent estimates or data available to Sparton, and more work needs to be done to upgrade or verify these historical estimates. Further, a qualified person under NI 43-101 has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves; and Sparton is not treating the historical estimate as current mineral resources or mineral reserves. Work Program Two key areas will initially be evaluated. Past drilling in the Avocalon-Aurora area has returned several intersections that merit follow up. These include: 5.32 grams gold/tonne over 2.44 meters, 6.51 grams gold/tonne over 2.13 meters (drill hole P-6) and 5.5 grams gold/tonne over 4.51 meters (drill hole P-8) by Potter Gold Mines in 1963 (Quebec MGRN report GM 13612). These are associated with an induced polarization (“IP”) anomaly and shear zone near the margin of the main Bruell Pluton. A second area northwest of the Bruell intrusion has drill holes by Bellechasse Mining Corporation (“BMC”), and Placer Dome Inc. (optioned from BMC, Quebec Reports GM43883,44670,48645, 1985-1989), with intersections of 4.8 grams gold/tonne over 6.4 meters and 3.4 grams over 2.5 meters also associated with IP anomalies. The lateral and depth extensions of the intersections in these areas, adjacent to and into the Bruell Pluton have not been covered by geophysical surveys, drilled, or otherwise explored. All of these intersections are reported as core lengths and true widths are estimated to be 70% to 90% of the numbers reported based on cross section data and measured inclinations of the mineralized zones. Data verification for Quality Assurance (“QA”) and Quality Control (“QC”) protocols for assay data for the early Potter work cannot be verified as there were no regulatory reporting requirements at that time. QA and QC for work done by Placer Dome however, for the Bellechasse option, would have been consistent with those for a major mining company fully familiar with gold exploration and assay methodologies. The assessment reports reviewed for both programs indicate that well known reputable assay laboratories were used with normal internal QA-QC protocols for blank, internal standards, and duplicate assays. Work Program All data available for the property is being compiled and a field program to relocate past drill holes and survey grids will be undertaken shortly. A comprehensive ground magnetic survey will then be completed and various zones prioritized for drilling. Additional location maps and historical exploration data will be posted shortly on the Company website www.spartonres.ca. “The opportunity to explore this very prospective and strategically located gold property in a proven area of Canada is very exciting. The Company, through its subsidiary VanSpar Mining Inc., will continue its activities in the vanadium sector, including the development and exploitation of high grade vanadium prospects it has identified in China. The addition of a domestic project at Bruell provides us with mineral diversification and additional financing flexibility.” A. L. Barker M.A. Sc., P.Eng., P.Geol. is the Qualified Person under NI 43-101 for the technical information in this news release and has reviewed all available data for the Bruell Property and approved the contents of this news release.

Listed: TSX Venture Exchange Forward-Looking Statements

|